Creating Economic Value by Design

School of Design, The Hong Kong Polytechnic University, Hong Kong

This paper examines the influence of major economic theories in shaping views of what constitutes value as created by design. It begins by examining Neo-Classical theory, which is dominant in the English-speaking world and underpins the ideology of the so-called “free market” system. Its focus on markets and prices as set by market forces are believed to solve all problems if left free from government interference. The implosion of this system and its emphasis on unrestricted individualism is a crisis of theory as well as practice. There are, however, other economic systems that relate to design in a more positive manner, such as Austrian theory and its belief that users determine value; institutional theory, which examines the influence of contexts and organizations; or New Growth Theory, which asserts the power of ideas as an unlimited resource in economic activity. These offer a window to business activity that enables designers to communicate the value of their work. Moreover, if the practical implications of these theoretical positions are understood by designers, it becomes possible to construct an extension of them that specifically addresses what the economic contribution of design can be in terms that business managers can understand.

Keywords – Design, Value Creation, Innovation.

Relevance to Design Practice – Communicating clearly the value of design that designers can contribute to any organization is a continuous challenge. Understanding economic theory as it shapes business attitudes and conversely, how design can shape economic value, can be a valuable means of integrating design into business thinking.

Citation: Heskett, J. (2008). Creating economic value by design. International Journal of Design, 3(1), 71-84.

Received October 5, 2008; Accepted December 11, 2008; Published April 15, 2009.

Copyright: © 2008 Heskett Copyright for this article is retained by the authors, with first publication rights granted to the International Journal of Design. All journal content, except where otherwise noted, is licensed under a Creative Commons Attribution-NonCommercial-NoDerivs 2.5 License. By virtue of their appearance in this open-access journal, articles are free to use, with proper attribution, in educational and other non-commercial settings.

Corresponding Author: john.heskett@polyu.edu.hk.

Introduction

This paper is an attempt to summarize work undertaken over several years on the relationship between economics and design. The origins of the project go back to meetings with officials of the U.S. Federal Department of Commerce and the Council on Competitiveness in the mid-1990s. The officials were all economists and it rapidly became clear their concept of design was of something superficial, easily copied and not really capable of generating value. They were educated, intelligent and courteous people, but it was clear that design had no role of any significance in their view of the economic world.

Obviously for some reason, the discipline of economics does not acknowledge design. To be fair it must also be acknowledged that the discipline of design is deficient in communicating its economic role. Some designers might ask: why bother? My answer to that would be that basically, design is a professional business activity practiced overwhelmingly within business contexts and if designers cannot argue the economic relevance of their practice in convincing terms, the views of the officials I met in Washington will be justified and they will remain what the American designer, George Nelson, long ago termed “exotic menials.”

The work of Herbert Simon, Nobel Laureate in Economics in 1978, is a rare exception of design being considered as a factor in economic theory. His starting point was acknowledging that the world we inhabit is increasingly artificial, created by human beings. For Simon (1981), design was not restricted to making material artefacts, but was a fundamental professional competence extending to policy-making and practices of many kinds and on many levels:

Everyone designs who devises courses of action aimed at changing existing situations into preferred ones. The intellectual activity that produces material artifacts is no different fundamentally from the one that prescribes remedies for a sick patient or the one that devises a new sales plan for a company or a social welfare policy for a state. Design, so construed, is the core of all professional training; it is the principal mark that distinguishes the professions from the sciences. (p.129)

Implicit in Simon’s reasoning is an emphasis on design as a thought-process underpinning all kinds of professional activities; yet the varied skills through which design is manifested are not discussed. He did indicate, however, why design is so rarely considered in economic theory. Economics, he stated, works on three levels, those of the individual; the market; and the entire economy (p. 31). The centre of interest in traditional economics, however, is markets and not individuals or businesses (p. 37). A serious problem is thereby raised at the outset: two important considerations relating to design—how goods and services are developed for the market place and how they are used—receive scant attention.

Markets and Prices - Neo-Classical Theory

The focus on markets as the major arena of economic activity is a characteristic of Neo-Classical theory, which emerged during the late-nineteenth century to become the mainstream of economic thought in the modern world. Its context was Great Britain’s rise to global industrial dominance, later overtaken by the United States – so its origins are deeply rooted in the English-speaking world. At its heart is a concept of markets and how they operate as mechanisms to allocate resources. Out of the processes of competition, the theory claims that market mechanisms, if left to their own workings, will yield the most efficient allocation.

In fact, the arguments go much further than that. Their most influential advocate in modern times has been Milton Friedman (1962), who argued that markets are an indispensable component of political freedom, by ensuring diversity of choice and by limiting the scope and power of governments to a minimal role.

What the market does is to reduce greatly the range of issues that must be decided through political means, and thereby to minimize the extent to which government need participate directly in the game. … The great advantage of the market, on the other hand, is that it permits wide diversity. It is, in political terms, a system of proportional representation. (p. 15)

The argument that the market can be considered politically as a form of proportional representation is typical of Friedman’s popularization of an idealized assessment of the efficacy of markets. In contrast, it is possible to argue that markets are a form of disproportionate representation. Possessors of great wealth and major business organizations have a power in modern society that is hardly justifiable in terms of political democracy, particularly since Friedman (1962) rejected any view of “social responsibility” for corporations “beyond serving the interest of their stockholders or their members” (p. 133).

Originally, markets were specific places in towns or villages where people gathered to exchange goods and services. Today, these are overlaid by markets that range across the globe and are complex, impersonal and intangible, but nevertheless still remain essential mechanisms for exchanging goods and services.

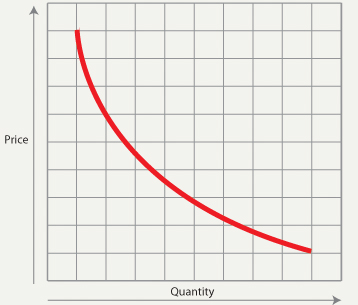

Basic concepts in Neo-Classical theory explain how supply and demand are reconciled in any market. A market only exists because of scarcity: it fills the need to allocate goods that are scarce in relation to the number of people desiring them. A further assumption about supply is that the price of each unit decreases as the quantity produced increases, which is made possible by economies of scale due to increased efficiency in manufacturing large quantities (Figure 1).

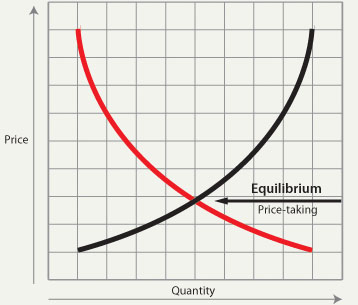

Complementing supply is demand: what people are prepared to pay for goods and services. Demand increases as larger quantities become available at lower prices (Figure 2). Equilibrium is the point where supply and demand intersect and determine the price customers are prepared to pay. Equilibrium implies balance and is essentially a static condition.

Figure 1. Supply.

Figure 2. Supply and Demand.

These concepts are rudimentary—the kind any student of economics learns in their first lessons; obviously, Neo-Classical theory is immensely more sophisticated. Nevertheless, some important points arise even at this simple level. Firstly, price is the major determinant of value, which ignores other factors such as quality or differentiation; secondly, goods are assumed to appear on the market without any consideration of how they got there, i.e., consideration of product development processes and the role design plays in them are conspicuously absent; thirdly, firms have no role in this theoretical depiction, they are assumed to be price-takers, passively accepting the price determined by the market; and fourthly, markets are depicted as static, but in fact are constantly changing in innumerable ways.

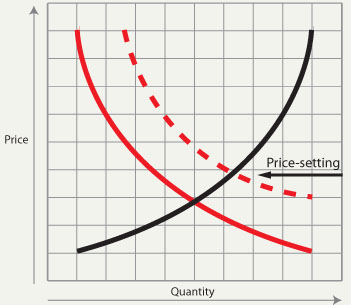

Figure 3. Price-setting replacing the interplay of supply and demand.

Harold Demsetz (1977), a distinguished American economist, stated the situation very clearly:

Neo-Classical theory’s objective is to understand price-guided, not management-guided, resource allocation. The firm does not play a central role in the theory. (p. 426)

This clearly positions design outside the parameters of Neo-Classical theory. Yet in reality, many companies function as price-setters—targeting people who will willingly pay more for products embodying superior qualities. James Dyson’s first vacuum cleaners (Figure 4) introduced in Britain in 1993 were double the price of his cheapest competitors. Yet against established multi-national companies, the superior performance of his start-up products attained market leadership in the UK inside two years, an achievement subsequently mirrored in other markets.

Figure 4. Dyson DC01 and DC02 vacuum. (Image Source: www.dyson.com. Reprinted with permission.)

Design, as demonstrated by the Dyson example, is essentially about change, and concepts of equilibrium have limited relevance in explaining change.

Neo-Classicism explains how goods and services are generated for markets in terms of two main production functions: the amounts of labour and capital employed in production. Again, these production functions can be quantified to explain the cost of what is produced, but do nothing to help understand what is produced, why or how. Neither do they explain beyond the dimension of cost, what quality and value might be in other terms than monetary value.

Consumers are assumed to act in terms of rational calculation in market decisions and have three characteristics (McCormick, 1997):

1. Their tastes are consistent.

2. Their cost calculations are correct.

3. They make those decisions that maximize utility.

Rationality is expressed in quantifiable terms. Mathematical methodology stresses what is consistent and calculable and whatever is unstable or indefinable is discarded, or as critics of Neo-Classicism assert, facts must fit the methodology.

Another static model is the condition termed perfect competition, in which the interplay of supply and demand in the market is assumed to be subject to no hindrances of any kind. Everyone has access to the same information about the same products. Choice is assumed to be a matter of rationally selecting what is available within an established range.

Curiously, these beliefs about how markets work to efficiently allocate resources rests upon what can only be described as an act of faith without rational proof. The founder of modern economics, Adam Smith (1776/1937), explained this in terms of a concept of “the invisible hand of the market” (p. 423). He wrote of any individual being led in their investment of capital “by an invisible hand to promote an end which was no part of his intention” (p. 423). If not interfered with, (under conditions of perfect competition,) the pursuit of enlightened self-interest by each entrepreneur and consumer produces the most efficient result to the greatest benefit of all.

Markets are therefore the sum total of each individual’s attempts to maximize their own advantage. However, if any buyer or seller can manipulate a good’s price or distort the market mechanism, then a condition of imperfect competition occurs, a condition that encompasses most design work.

On the important question of value, Adam Smith defined two aspects, which he termed value in use and value in exchange. Beyond acknowledging its importance, he has little to say about value in use since it has no direct economic relevance.

The things which have the greatest value in use have frequently little or no value in exchange; and on the contrary, those which have the greatest value in exchange have frequently little or no value in use. Nothing is more useful than water: but it will purchase scarce any thing; scarce any thing can be had in exchange for it. A diamond, on the contrary, has scarce any value in use; but a very great quantity of other goods may frequently be had in exchange for it. (Smith, 1776/1937, p. 28)

Just as there is little in Smith’s Wealth of Nations to enlighten us as to why people find things useful or desirable, neither in Neo-Classical theory is there substantial concern with how products might be different. If market decisions are indeed based on goods which already exist, there is little left on which to focus beyond price and quantity.

How can these static assumptions be credible? The answer is that in reality, markets for many products do indeed fit these criteria.

Highly standardized products, for example, basic commodities such as oil or wheat, or consumer products such as beer, soft drinks and cigarettes (see Figure 5), or shares on any stock exchange transaction, are not generally subject to change in their essential character or how they are produced. This being the case, they are open to rational, numerical inquiry, as Demsetz (1977) points out:

When economists analyze the consumption behavior of households, the employment choices of workers, and the investments of capitalists, their conclusions are largely drawn from the wealth consequences that flow from alternative decisions. We do not have much to say about tastes and how these may differ across persons and situations, but, in principle, variations in tastes also explain variations in behavior. Our focus, not exclusively but most often, is on wages, prices, rates of return, and budget constraints. This works quite well in practice if most tastes change only slowly (my emphasis, JH). (p. 8)

Demsetz confirms the importance of innate “measurability” and avoids “taste” with all its uncertainties and volatile unpredictability.

Figure 5. This range of American consumer products has images which, in essence, change very little over time.

(From left to right, photo by Ryan Fung, Tim Snell, Ting-Ju Lin, and Scott Kessler. Reprinted with permission.)

If the assumptions of Neo-Classical theory explain commodity markets, they are more fragile in situations where criteria other than cost and quantity become significant in market choice. The processes of creating new products or product variations, based on an assumption that someone has a better idea than their competitors, by definition creates imperfect competition and, inevitably, a state of disequilibrium as a permanent condition.

Another frequent criticism of Neoclassicism revolves around its stress on an individualistic view of society, with social values considered as an arithmetical sum total of individual intentions.

Neoclassical economics involves an individualistic view of efficiency. Efficiency is defined as the allocation of resources to “the highest,” that is, monetarily most remunerative, uses. Social efficiency is additive, that is, the summation of private individual efficiencies. (Klein & Miller, 1996, p. 267)

The potential tension between individuals’ desires to pursue their own benefit and their simultaneous need for protection from the actions of others requires people to behave in very different ways in varying situations.

Culturally, …a key requirement for a market system will be a set of values in society that offer vigorous encouragement to self-interest in the market and yet maintain powerful normative inhibitions on the expression of self-interest in many other less socially acceptable areas. (Nelson, 2001, p. 6)

As is apparent at present, self-interest easily translates into greed. Therefore, if self-interest is encouraged in economic affairs, how do we reconcile this with the need to prevent other people from stealing the contents of our home, mugging us on the street, or pirating a shipment of goods? Choices have to be made in reality between pizza and police forces, or cigarettes and social welfare programs. In Neo-Classical theory this leads to a distinction between private goods - bought at a price - and public goods - paid for by taxes. The former are included in the market model and therefore are depicted as beneficial. The latter are not subject to market forces and are widely viewed as a distortion of market models. Once in existence, public goods are available to additional people at no cost. An example is street lighting—there is no competition between suppliers that enables us to choose between alternative lighting systems when we move down a street.

An important criterion by which private goods are distinguished from public goods is excludability, or in other words, private goods are those where one person’s consumption precludes consumption of the same item by another person. When a supplier can prevent some people from consuming the product - those who do not pay - then the product is excludable and can be supplied by means of a market.

For those preaching the virtues of “free markets,” excludability is at the heart of the economic system and there is a constant struggle to extend and protect its boundaries. A good example of such an extension is parking. In the early days of automobiles, parking on the sides of roads in cities was open to anyone and was therefore non-excludable. As soon as spaces were demarcated and parking meters installed, with payment enforceable by law, parking became excludable. An even more remarkable extension is the tangled web of “intellectual property rights,” based on the proposition that even ideas can be owned.

In terms of these concepts, it is easy to see how design can be regarded as non-excludable and therefore of little economic value. On some levels, its outcomes are easily copied. New fashion designs, for example, will be on the streets around the world via major clothing chains within two weeks of them appearing at exclusive fashion shows in Paris, Milan, London or New York. Attempts to give designs protection by licensing systems analogous to patenting can be evaded by slight modifications of form, pattern or colour. Product or graphic designs are also widely imitated by competitors. Innumerable companies around the world specialize in being “fast-followers,” adept at rapidly producing imitations of successful innovations at low cost. For this reason, design can be considered as something virtually impossible to exclude, something that can be easily acquired at no cost by competitors.

However, nowadays Neo-Classicism is increasingly questioned because it does not explain many crucial aspects of development. Technological innovations on every level of life, changing products, processes and organizations, have created economic growth and substantially improved living standards. Yet, strangely, in Neo-Classical theory, technological progress is not explained, but has the status of an exogenous variable, something known to be an influence, but outside the loop of what is clearly understood and can be quantified, in contrast to an endogenous factor—something integral to a process or model and clearly definable. In Neo-Classical thinking, technology functions in indefinable ways, as a black box, the workings of which cannot be known. This creates a strange situation:

Technological progress was seen as something that simply rained down from heaven. Studies show that, in most economies, higher inputs of labour and capital account for barely half the total growth in output this century. The huge unexplained residual was labeled “technological change”, but in truth it was a measure of economists’ ignorance. (Anonymous, 1996, p. 57)

If it is “a measure of economists’ ignorance,” as The Economist termed it, (and which journal is better qualified to judge this?), then it also has the more serious implication that Neo-Classical theory addresses only half of what it purports to explain. If increases in investment do not adequately account for an economy’s long-term rate of growth, it requires greater understanding of the role of technology and design than has hitherto existed. Fortunately, other tendencies in economic theory with alternative models of how markets function offer greater hope for opportunities to explore the economic role of design.

Value and Change: Austrian Theory

Many aspects of Neo-Classical theory were questioned and modified by a group of scholars who initially came from Austria, although adherents are now found in many countries. This group of scholars and their theories are now referred to as the Austrian School. An important emphasis in their early work was on how value is attributed to products, which was also a major emphasis of the founder of the Austrian School, Carl Menger (1840-1921). In 1871, he wrote:

Value is thus nothing inherent in goods, no property of them, nor an independent thing existing by itself. It is a judgment economizing men make about the importance of the goods at their disposal for the maintenance of their lives and well-being. Hence value does not exist outside the consciousness of men. (Menger, 1871/1976, p. 121)

It is difficult to overestimate the importance of this insight. Understanding that value is subjective and determined by users is of crucial importance for design and business, and yet many designers and managers continue to believe that their decisions determine value. Menger (1871/1976) is emphatic on this point:

There is no necessary and direct connection between the value of a good and whether, or in what quantities, labor and other goods of higher order were applied to its production. (p. 147)

Menger’s followers extended his ideas, among them Friedrich von Wieser (1891), who argued that although value in exchange is objective in terms of being defined by price, value in use is not only particular to individuals but is subjective, leading to the further question: “why do men prize commodities?” (p. 118). Neglecting subjective values, Wieser argued further, “would thereby leave unexplained all individual decisions in economic matters, e.g. it would not even explain why any one buys” (p. 119). Wieser therefore emphasizes that although the subjective dimension is indeed not easily specified, this is no reason to omit it from any explanation of buyers’ behaviour. Thus the early work and ideas of the Austrian School explored a radical concept of value, which more closely approximates the behaviour of users in purchasing. This can be illustrated by an object with a basically simple function, such as a lemon squeezer (see Figure 6), which yet reveals great diversity in the forms and materials used and equally great price differentials. Why this diversity? All the examples perform the required function effectively, but the actual range of forms and materials is exceedingly varied and confirms the arguments of Menger and Wieser on the role of value and taste in choice decisions, in contrast to the stress on price and rationality in Neo-Classical theory. The Austrian school therefore opens up more accurate depictions of how design innately functions and generates value in an economic context.

Figure 6. Four very different lemon squeezers in term of materials, form, cost, and taste.

Austrian ideas were further elaborated in the twentieth century by Ludwig von Mises and Friedrich von Hayek. For Mises (1949), action is only comprehensible in terms of the ideas that generate it. “Human action,” he wrote, “is purposeful behavior” (p. 11). Its aim is change to achieve improvement in some way.

Acting man is eager to substitute a more satisfactory state of affairs for a less satisfactory. His mind imagines conditions which suit him better, and his action aims at bringing about this desired state. (Mises, 1949, p. 13)

Human meaning and action, therefore, do not derive from a static world, but one that is in ceaseless ferment.

Hayek (1948) similarly argued that if theory was to be validated in empirical reality, it had to be dynamic. “It is, perhaps, worth stressing,” he wrote, “that economic problems arise always and only in consequence of change” (p. 82). Competition innately involves change, and he noted that Neo-Classical theory tended to avoid its consequences: “... competition is by its nature a dynamic process whose essential characteristics are assumed away by the assumptions underlying static analysis” (p. 94). The concept of “perfect competition” was another target in his critique of how Neo-Classical models eliminated some of the most important elements of how markets actually worked:

... how many of the devices adopted in ordinary life to that end would still be open to a seller in a market in which so-called “perfect competition” prevails? I believe that the answer is exactly none. Advertising, undercutting, and improving (“differentiating”) the goods and services produced are all excluded by definition—”perfect” competition means indeed the absence of all competitive activities. (Hayek, 1948, p. 96)

Hayek did not explore the concept of “differentiating,” or other references to branding and advertising in anything other than the most general terms, but he was clearly aware of their role as vital elements in competitive processes.

In fact, it need hardly be said, no products of two producers are ever exactly alike ... These differences are part of the facts which create our economic problem, and it is little help to answer it on the assumption that they are absent. (Hayek, 1948, p. 98)

Hayek’s emphasis on economics being innately concerned with the consequences of change and its relevance to design can be illustrated by substituting the word “design” for “economic” in the quotation below.

The solution of the economic problem of society is in this respect always a voyage of exploration into the unknown, an attempt to discover new ways of doing things better than they have been done before. ...all economic problems are created by unforeseen changes which require adaptation. (Hayek, 1948, p. 101)

Acknowledging the huge range of human skills, knowledge, tastes and needs meant for Hayek that attempts by the state to impose centralized solutions on problems would not only reduce economic efficiency, but restrict individual freedom. In this regard, Hayek is most famous for his book, The Road to Serfdom, published at the end of the Second World War, which is a compelling defence of individualism against the centralized planning he saw emerging in even ostensibly democratic societies.

The influence of the Austrian School reached far beyond the geographical boundaries of Austria. In the United States it also had a profound impact on management theory through the work of Peter Drucker, who was born and educated in Austria and whose views are a classic manifestation of Austrian economic ideas. One hundred and fifteen years after Menger (1871/1976) articulated the basic principles of the school, Drucker (1986) trenchantly restated them in terms that have been a constant theme in his writings:

“Quality” in a product or service is not what the supplier puts in. It is what the customer gets out and is willing to pay for. A product is not “quality” because it is hard to make and costs a lot of money, as manufacturers typically believe. That is incompetence. Customers pay only for what is of use to them and gives them value. Nothing else constitutes “quality.” (p. 228)

If quality is a factor in competitive success, it is highly relevant in discussing the economic value of design.

Conspicuous Consumption and Workmanship: Institutional Theory

Austrian theory locates economics in the context of a broader human concept of nature, and a further broadening is evident in Institutional theory, which seeks to explain differing levels of economic performance in firms and nations by examining the influence of history, culture and institutions.

The generally acknowledged founder of Institutional theory is Thorsten Veblen, who from the 1890s onward framed arguments that throughout history two human tendencies were in conflict over responses to new developments, distinguished by an emphasis on production and acquisition. The first, production, strove for creative adjustment to the new, expressed primarily in efforts to shape new materials and processes into useful artefacts; in contrast, acquisition was characterized by possession, preserving privilege and averting or restricting the new. The latter was the target of his first major book, The Theory of the Leisure Class (Veblen, 1899/1994), in which he coined the phrase “conspicuous consumption” (p. 75). He depicted the emergence of a leisure class as synonymous with ownership, which has nothing to do with the necessary subsistence minimum, being instead concerned with the demonstration of superfluity, either in terms of time or of goods.

The relation of the leisure (that is, propertied non-industrial) class to the economic process is a pecuniary relation—a relation of acquisition, not of production; of exploitation, not of serviceability. (Veblen, 1899/1994, p. 209)

Veblen’s concept of conspicuous consumption extended far beyond what was functionally necessary and focused on the display of products as an index of wealth and status:

… most objects alleged to be beautiful, and doing duty as such, show considerable ingenuity of design and are calculated to puzzle the beholder—to bewilder him with irrelevant suggestions and hints of the improbable—at the same time that they give evidence of an expenditure of labour in excess of what would give them their fullest efficiency for the ostensible economic end. (Veblen, 1899/1994, p. 152)

The other pole of Veblen’s thought was the subject of another seminal work The Instinct of Workmanship (Veblen, 1918/1990), which focused on the role of production and examined the linkage between technology and institutional organization across human history through “practical expedients, ways and means, devices and contrivances of efficiency and economy, proficiency, creative work and technological mastery of facts” (p. 33). However, this concept of workmanship does not exist in isolation, but instead is drawn into value systems other than those unique to it, creating a problem that Veblen calls “contamination”:

So also, to the current common sense in a community trained to pecuniary rather than to workmanlike discrimination between articles of use, those articles which serve their material use in a conspicuously wasteful manner commend themselves as more serviceable, nobler and more beautiful than such goods as do not embody such a margin of waste. (p. 217)

Veblen’s (1899/1994) identification of “economic beauty” in terms of simplicity of form anticipated the emergence of the body of aesthetic theory collectively known as Modernism:

So far as the economic interest enters into the constitution of beauty, it enters as a suggestion or expression of adequacy to a purpose, a manifest and readily inferable subservience to the life process. This expression of economic facility or economic serviceability in any object—what may be called the economic beauty of the object—is best served by neat and unambiguous suggestion of its office and its efficiency for the material ends of life. (p. 209)

Veblen’s criticism targeted the often vulgar manifestations of wealth by elites in the so-called Gilded Age of new commercial wealth in late nineteenth-century America that moved in top-down manner to influence a broader spectrum of society. In the contemporary world, however, conspicuous consumption has moved down-market. In China, for example, where Western brands have become an index of status, the Louis Vuitton logo is prized as an indicator of social aspiration to a degree that young women working in relatively low paid jobs will spend a month’s salary on a Vuitton wallet.

Another development that did not feature in Veblen’s day, was a bottom-up tendency that can affect broad swathes of society. In the USA, what began as a movement among deprived inner-city African-American youth known as Hip-Hop, has spread to middle-class white suburban youth and morphed into a huge commercial phenomenon with an elaborately decorative visual expression known as “bling-bling” based on exotic and often bizarre forms (see Figure 7). In this case, conspicuous consumption has become a powerful assertion of cultural identity.

Figure 7. American Hip-Hop musician Busta Rhymes and on-line jewellery company HipHop.com exemplify the trend known as “bling-bling”, a variation of conspicuous consumption that strikingly asserts the identity of inner-city African-Americans through elaborately decorative and often exotic forms. (Image Source: http://www.hiphopbling.com. Reprinted with permission.)

This distinction between “the productive” and “the acquisitive,” or “the industrial” and “the pecuniary” in modern society remained a central and generally pessimistic feature of Veblen’s theories and they are still of great importance in understanding not just contemporary design, but the financial crash that is sweeping the world at the time of writing.

Another important contribution of Institutional theory has been on the subject of the firm. “The Nature of the Firm,” a landmark paper in this direction written by Ronald Coase in 1937, questioned Neo-Classical arguments that the price mechanism determines how markets allocate resources. If this was so, he asked, what was the reason for the existence of firms?

In examining the actual workings of firms, he identified functions beyond those associated with production termed “transaction costs,” which included everything essential to how a firm undertook its business, such as purchases of materials and supplies, banking, legal and insurance costs, information and promotion, design and delivery. Minimizing transaction costs was therefore suggested as the primary function for firms. Otherwise, Coase (1998) asserted in a trenchant critique of Neo-Classicism, the situation will remain that “economists study how supply and demand determine prices but not the factors that determine what goods and services are traded on markets and therefore are priced ” (p. 72).

In recent years, C. Douglass North has emerged as a powerful influence in institutional thinking. The first economic historian to be awarded the Nobel Prize in Economics in 1993, he believes history is important not for its own sake, but as a crucial means of understanding the present and facing the problems of the future. He emphasises the role of institutions in giving structure to life in a society. Basically, they establish the rules of the game, which leads to a distinction between institutions and organizations or between the rules and the players. In comparable social terms, institutions such as laws, customs and habits set the essential framework of activity, within which organizations are the players.

If institutions can be described as self-imposed constraints that bring order and structure to a society, what then is their economic importance? According to North (1990), this lies in how they affect the costs of exchange and production. In addition, institutions are crucial in explaining historical patterns of how societies have changed in such divergent ways with very different performance characteristics, and can give insights into how change might take place in the future. The manner, for example, in which a firm organizes, structures and manages design will very largely determine the quality of work generated.

An example is the Italian electrical manufacturer Olivetti, which insisted that its designers, no matter how prestigious, should only work no more than half-time for them. The designers were expected to do work of other kinds with other companies to keep themselves fresh and stimulated. The outcome was a very high standard on many levels - products, graphics, exhibitions and packaging - that was sustained over forty years. Olivetti became a design icon among the world’s manufacturing companies, which was also reflected in sustained and competitive sales of its products. By the 1990s, however, that institutional advantage proved inadequate to cope with changes resulting from the spread of digital technology – illustrating that institutional forms are indeed powerful, but not immutable over time.

Understanding how institutions function is in large measure dependent upon the concept of human nature that informs any social theory. In rejecting the rational theory assumptions of perfect competition, North (1990) asserts, similarly to adherents of Austrian theory, that when purchasing anything individuals make subjective choices on the basis of incomplete information. He points out:

We get utility from the diverse attributes of a good or service or, in the case of the performance of an agent, from the multitude of separate activities that constitute performance. ... when I buy an automobile, I get a particular color, acceleration, style, interior design, leg room, gasoline mileage - all valued attributes, even though it is only an automobile I buy. ... The value of an exchange to the parties, then, is the value of the different attributes lumped into the good or service. ...

From the particulars in the foregoing illustrations we can generalize as follows: commodities, services, and the performance of agents have numerous attributes and their levels vary from one specimen or agent to another. The measurement of these levels is too costly to be comprehensive or fully accurate. (pp. 28-29)

North identifies here a prime difficulty in providing quantifiable demonstrations of design’s value – when integrated into product development processes it is virtually impossible to disentangle the precise contribution of design, or any other discipline, to the final outcome.

The task of management, according to North, is to acquire the appropriate knowledge of products, production and markets in situations of uncertainty and risk. What knowledge is acquired and how it is applied will be decisive for the future not only of firms but also of societies. He therefore identifies institutions and technology as the building blocks of change, although technology is more open to the effects of individual decision-making since institutions are more embedded in a complex range of political, economic, social and cultural influences.

While North acknowledges the need for formal rules, he also stresses informal behaviour: rationality is balanced by subjectivity, stability by change, the macro-economic dimension related to the micro-economic. His reference point in history gives an awareness of how change has actually taken place and enables theoretical positions to be tested against a spectrum of historical occurrences.

Knowledge and Technology: New Growth Theory

New Growth Theory emerged in the U.S. in the 1980s. A forerunner was Joseph Schumpeter, who was born in Austria, but in 1932 left for the USA on appointment to Harvard University.

By the 1930s, Schumpeter was depicting growth as innate to capitalism, driven by the interaction of technological development and competition between firms. This also directly opposed the static views of Neo-Classicism:

Capitalism, then, is by nature a form or method of economic change and not only never is but never can be stationary. ... The fundamental impulse that sets and keeps the capitalist engine in motion comes from new consumers’ goods, the new methods of production or transportation, the new markets, the new forms of industrial organization that capitalist enterprise creates. (Schumpeter, 1942, p. 83)

Schumpeter did not detail the new goods and markets generated by this dynamism, but strongly emphasized the role of innovation as the main stimulant of growth. Historically, he discerned waves of technological revolution sweeping old industries away and replacing them by new ones in a process of “creative destruction,” (perhaps Schumpeter’s most famous phrase). Each new wave would fire-up investment and provide jobs to replace those lost.

Schumpeter (1942) also criticized the incapacity of Neo-Classical theory to deal with dynamic changes:

... the problem that is usually being visualized is how capitalism administers existing structures, whereas the relevant problem is how it creates and destroys them. (p. 84)

Price, Schumpeter concluded, was therefore not the dominant criterion in competition. To expand upon Schumpeter’s basic insights has been the role of the leading proponents of New Growth Theory, among them, Paul Romer, Paul David, Nathan Rosenberg and W. Brian Arthur.

Romer’s (1992) emphasis is the missing element of technology, incorporating it directly into models of economic growth by explaining how knowledge is created and spread. Unlike the two conventional factors of production, labour and capital, he argues, ideas are not scarce. Therefore a sustained flow of ideas for more efficient processes and new products potentially makes continuous growth possible. Knowledge of technology and experience in its applications can appreciate into human capital, a powerful concept in explaining why many firms are more proficient than others in innovation.

To labour and capital, Romer added knowledge as a production function, making it more plausible.

Nathan Rosenberg (1982) similarly emphasizes knowledge in making technology into an effective instrument beyond price competition:

... technical progress is not one thing; it is many things. Perhaps the most useful common denominator underlying its multitude of forms is that it constitutes certain kinds of knowledge that make it possible to produce (1) a greater volume of output or (2) a qualitatively superior output from a given amount of resources. (p. 3)

For Romer (1992), emphasising knowledge requires a basic shift in approach: “... the difference between the economics of ideas and the economics of objects is important for our understanding of growth and development” (pp. 63). This point is vital in comprehending many developments in contemporary economies:

... take oranges as an example of a product that’s an ordinary object. There’s a cost of producing each additional orange, and the cost of the next orange is pretty much the same as the cost of the last one. You’ve got to give up the use of some land, plant new orange trees, harvest the oranges and so on. So each orange has a constant cost of production. (Robinson, 1995, p.66)

Increases in the production of objects achieved by a replication of existing, known methods of production will therefore yield an increase on the basis of constant or diminishing returns to scale. Romer then compares the economics of objects with the economics of ideas, using the example of the polymerase chain reaction (PCR), which is a simple technology for taking a tiny amount of DNA and multiplying it.

An incredible amount of research expense went into the discovery of PCR. But once it was discovered, it was just basically a recipe. The recipe could just be published on the Internet, and then anybody in the world would be able to use this amazing technology at zero additional cost. So the key difference between objects and ideas—between oranges and a high-tech process like PCR—is this: Objects tend to have a constant cost per unit. But ideas have a huge cost for the first unit, then essentially zero costs for each additional unit. (Robinson, 1995, p. 66)

“Ideas,” says Romer, “are routinely ignored” (Robinson, 1995, p.67). He points out, however, that they are crucial generators of value, making a decisive difference not only in big discoveries, but also in constant incremental improvements, as illustrated by Japanese manufacturers in their extraordinary rise to global leadership in many product sectors.

On Japanese assembly lines, the workers were supposed to experiment with slightly different ways of doing their jobs. Japanese workers were given the freedom, for example, to try putting the rearview mirror on the door before putting the door on the car, and then to try it the other way around, finding out which was more efficient. Over time, the Japanese gained a big competitive advantage. … This move toward institutionalizing the whole process of discovery is a really profound change in the nature of economic activity. (Robinson, 1995, p. 67)

Companies clearly need to understand that knowledge workers involved in various levels of discovery are significantly growing in numbers, becoming vital elements in the existence and success of firms, with a corresponding reduction in numbers of those who actually carry out the manufacturing function.

... if you think about it in terms of production at a company like Microsoft or a big drug company, you’ll see that by far the most important activity at those companies is getting the instructions right. …The fraction of workers at Microsoft who actually manufacture the physical product is very small. (Robinson, 1995, p. 67)

The concept of increasing returns, which is another substantial challenge to traditional economic theory, perhaps provides the best understanding of the potential for growth unlocked by these new theories. W. Brian Arthur (1996) argues that diminishing returns was a valid concept in the days of nineteenth century smokestack industry, and still is valid in resource-based industries such as agriculture and mining, but not in the new knowledge-based industries.

... steadily and continuously in this century, Western economies have undergone a transformation from bulk-material manufacturing to design and use of technology—from processing of resources to processing of information, from application of raw energy to application of ideas. As this shift has occurred, the underlying mechanisms that determine economic behavior have shifted from ones of diminishing to ones of increasing returns. (p. 100)

In high technology industries, when one firm gets an initial toehold in the market, it can establish a position of dominance, ensuring increasing returns rather than the slow wastage of diminishing returns.

The establishment of such dominance is characterized by the concept of lock-in, with one product or system establishing total control of a market. Arthur illustrates this with examples such as the DOS system, which became locked-in as the operating system of preference over Apple’s Macintosh system, and the victory of VHS over Betamax in the video-recorder market. In both cases, victory did not go necessarily to the best system either in terms of technical quality or operating simplicity, but to the system that established early dominance and reinforced it in every available direction.

A classic contemporary example is the way Apple created a new market with the introduction of its iPod and the iTunes system in late 2001, which revolutionized the retail music business. Despite intense competition from imitators around the globe, it has maintained its superiority due to consistent development of the product range, the continuing quality of its technology, and the strong design identity that characterizes it. By March 2008, over 150 million iPods had been sold worldwide, making it the best-selling digital audio player series ever. It is neither the cheapest, nor even the most technologically advanced product of its kind, yet it has a dedicated following locked into to what they believe is its innate superiority. It is surely one of the most compelling contemporary examples of the power of design when embedded in the culture of a business in all its aspects (iPod, n.d.).

Figure 8. Varied manifestations of the iPod line: the screenless iPod Shuffle, iPod Nano, iPod Classic, and iPod Touch. (Image Source: www.apple.com. Reprinted with permission.)

The emphasis on technology and ideas also opens up a greater emphasis on what is termed human capital, the kinds of knowledge important in sustaining growth. Paul David (1993) uses a distinction between tacit knowledge and coded knowledge, which draws on earlier work by Michael Polanyi (1983). Tacit knowledge refers to a vast range of procedures, a build-up of innate knowledge and inherent skills, derived from practical experience. The result, as Polanyi (1983) points out is that “... we know more than we can tell. ... So most of this knowledge cannot be put into words” (p. 4).

A commonplace example of tacit knowledge is learning to ride a bicycle. No set of instructions can give a recipe for this – one person’s knowledge cannot be directly transferred to another. The only way is through the slow and often painful process of trial and error. This type of knowledge is a crucial element in innumerable skills vital to firms and particularly important in design practice. The skills of drawing, for example, enable potential solutions to be probed in a variety of forms, without there always being an exact rationale for each. Choices of materials and colours can also rely more on this experiential sense of the “rightness” of a solution that is not always capable of logical explanation since it is rooted in a sensitivity based on substantial experience.

In contrast, however, other vital kinds of knowledge may need to be coded and explicitly communicated. This can take many forms–documentation in the form of patents, licensing agreements, proprietary information, contracts, formulae, data and manuals, or other formats. As projects increase in scale and complexity, so this other kind of knowledge also begins to assume greater importance in design practice.

In economic terms, this kind of coded knowledge is potentially a public good–in published forms it is potentially available to anyone with the ability to understand it. Once ideas are coded, they can be possessed by numerous people at the same time, and be made available to any number of people with little or no additional cost.

Romer’s ideas, although influential, have nevertheless been challenged from several directions. Once asked in an interview (CIO Insight, 2003): “If a greater and greater portion of the value of new ideas is going to the consumer and not to companies, will that reduce the incentives to create new ideas?” He replied:

The evidence seems to point in that direction. The very same highly competitive conditions that benefit consumers mean that a new entrant who has a valuable new idea doesn’t actually capture all of the value they create with that new idea. Lots of the value created by the new idea flows through to the consumer. The person who comes up with the new idea cannot patent and control all its benefits. What that means for the economy as a whole is there isn’t as much new idea creation as would be ideal. The incentives for creating new ideas aren’t as big as they should be. (p. 28)

This is a curious question and an even more curious response. It seems to imply that any value delivered to customers is in some way a deprivation of producers, who in addition, are liable to lose control of the idea. The emphasis is on producer-centred control and benefit, detached from any relationship to the customer and enhancement of the value delivered to them. Romer (CIO Insight, 2003) continues his answer to the problem in more detail:

So other economists and I have been arguing for a long time that the government has an important role in encouraging the creation of new ideas, and letting them get fed out into a market system where people can capture profits from innovating. Those profits are important, but they will never be big enough by themselves to encourage the amount of idea creation that would be ideal for the economy. The market is a wonderfully powerful engine for economic growth, but it runs much faster when the government turbo-charges it with strong financial and institutional support for education, science, and the free dissemination of ideas. (p. 28)

Romer’s emphasis on the role of government represents a very considerable modification of free-market ideas in their pure form. Again, however, a notable emphasis in this extended passage is that it is ideas controlled by producers that lead to profits. Consideration of how profitability might be achieved by designing better products and services for customers as a primary strategy is lacking.

The National System

Almost seventy years after Adam Smith published The Wealth of Nations, a German economist, Friedrich List, (1789-1846), completed his own major work, The National System of Political Economy, published in stages between 1841-4. List has remained little known in the English-speaking world, but his concepts have had continuing influence in his native Germany and continental Europe, subsequently percolating through to Japan and East Asia.

As a civil servant in the German state of Würtemburg, advocacy of reforms brought him into conflict with an authoritarian government and led to exile in the United States in 1825. There he edited a German language newspaper, became an American citizen and eventually returned to Germany in 1834.

He was strongly influenced by observing the effects of British industrialization and its growing competitive power on Germany, which made it difficult for German manufacturers to compete from a position of comparative technical backwardness. List regarded the advocacy of free trade by British politicians as a means of ensuring continued economic expansion and political dominance.

List had two primary objections to Smith’s ideas. Smith’s focus on the individual led to a concept of the economy and society based on the principles of laissez-faire, with state intervention reduced to a minimum. Secondly, List thought Smith’s emphasis on the division of labour neglected wider questions of the levels of skill and motivation necessary in manufacture.

In contrast, by the mid-1820s, List (1827/1996) elaborated an alternative view emphasising the role of nation states as the social organization within which individuals functioned. Instead of the division of labour, he proposed the concept of “productive power,” an umbrella term for the “deeper lying causes” that explain how a nation sustains its ability to produce in the context of a broader social concept of how economic wealth was created. This in turn led him to advocate a concept of the nation state actively intervening to ensure that productive powers were consistently developed and maintained for the benefit of the nation as a whole, which to some extent anticipates Romer’s concept of government subvention of idea generation (CIO Insight, 2003).

He believed that only the nation state exercised effective political and economic power (List, Ingersoll, Liebig, & Larouche, 1827/1996). “The object of the economy of this body,” meaning the nation state, “is not only wealth as in individual and cosmopolitical economy, but power and wealth, because national wealth is increased and secured by national power, as national power is increased and secured by national wealth. Its leading principles are therefore not only economical, but political too” (p. 31).

There was also a dimension of moral objection in List’s critique of Smith’s ideas. In addition to the separation of economic from social behaviour, List objected to the manner in which the concept of the division of labour led to a debasement of work. Instead he regarded skill and competence as essential in understanding economic achievement, and he anticipated on a national level the contemporary concept of intellectual capital to a remarkable degree. By 1827, he wrote of productive power essentially constituted by “the intellectual and social conditions of the individuals, which I call capital of mind” (List et al., 1827/1996, p. 63).

The present state of the nations is the result of the accumulation of all discoveries, inventions, improvements, perfections, and exertions of all generations which have lived before us; they form the mental capital of the present human race, and every separate nation is productive only in the proportion in which it has known how to appropriate these attainments of former generations and to increase them by its own acquirements... (List, 1827/1966, p. 140)

This broader concept of productive powers, the mental capital of a nation, is generated not only by those who create value in exchange, but also “the instructors of youths and of adults, virtuosos, musicians, physicians, judges, and administrators” (List, 1827/1966, p. 140) who are also responsible for creating productive powers.

In addition, the influence on List of his period of residence in the United States as a political refugee cannot be ignored. He was strongly influenced by what he learned of ideas and efforts to protect the nascent industries of the young republic, particularly the work of Alexander Hamilton.

As early as 1783, Hamilton argued against free trade, advocating that the new republic should regulate imports, so that “injurious branches of commerce might be discouraged, favourable branches encouraged, [and] useful products and manufactures promoted” (Chernow, 2004, p. 183). Later, in a Report on Manufactures commissioned by the U.S. Congress and submitted in December, 1791, Hamilton, by this time Secretary of the Treasury in President Washington’s administration, again recommended the promotion of manufacturing in the United States in much greater detail.

List (1827/1996) supported such ideas, arguing that each nation should seek to develop its productive powers in ways appropriate to its specific circumstances. He realized the changes wrought by industrialization meant that material resources, the capital of nature, were increasingly of less importance than the capital of mind in transforming those resources through invention. He saw this as a double-edged sword, capable of decimating existing industry if allowed to proliferate unchecked, but also of enhancing national productive power if carefully adapted by means of a protective national policy.

By securing the home market to home manufacturers, not only the manufacturing power for the supply of our wants is for all times secured against foreign changes and events, but an ascendancy is thereby given to our manufacturing powers in competition with others, who do not enjoy this advantage in their own country. (List et al., 1827/1996, p. 103)

Above all, List argued that, in principle, an economy based on division of labour must also be socially divisive. In contrast, the concept of a national economy encompassed not only a division of commercial functions between individuals but also the union of powers in a common cause. Industry, society and culture were therefore viewed as indissolubly linked in List’s vision of what an industrialized country could achieve. If not only protected but actively promoted by national policies, a beneficent cycle of improvement could lead to a constant enhancement of the achievements and potential of a country.

In the manufacturing State the industry of the masses is enlightened by science, and the sciences and arts are supported by the industry of the masses. There scarcely exists a manufacturing business which has not relations to physics, mechanics, chemistry, mathematics, or to the art of design &c. No progress, no new discoveries and inventions, can be made in these sciences by which a hundred industries and processes could not be improved or altered. (List, 1841-4/1966, p. 145)

Unlike Karl Marx, List did not advocate the replacement of capitalist society. He regarded competition within an economy as a vital necessity for its effective functioning, but argued that the industries of some countries needed protection until they could compete internationally on equal footing. In short, he was suggesting an alternative way in which capitalism could function, with countries such as Japan, South Korea and Taiwan providing compelling illustrations.

Design from the Standpoint of Economic Theory

The greatest problem in considering what economic theory explains about design, specifically or by implication, is in the context of Neo-Classicism, which in the Anglo-American world dominates both academic theory and applied economic practice. Neo-Classicism explains what exists and is not fundamentally concerned with what might be. Widespread criticism of it focuses on assumptions about the static nature of products and markets. If they are as constant as depicted in Neo-Classical theory, this at best reduces design to a trivial activity concerned with minor, superficial differentiation of unchanging commodities -- a role, indeed, that it does frequently perform. At worst, it contradicts the whole validity of design.

In contrast, a central assumption of design practice is that it is innately concerned with change: designers’ concepts become the products, communications, environments and systems of the future. Design, in other words, is about envisioning change.

An obsession with short-term financial profitability at the expense of on-going product and service development is also a consequence of Neo-Classical theory, with disastrous results evident in the current financial crisis. When General Motors went to plead for bail-out funds from the American Congress on December 5th, 2008, Micheline Maynard (2008) writing in the New York Times commented:

G.M.’s biggest failing, reflected in a clear pattern over recent decades, has been its inability to strike a balance between those inside the company who pushed for innovation ahead of the curve, and the finance executives who worried more about returns on investment.

As soon as the possibility of change, development and innovation are admitted into economic models, however, the perspective shifts and it becomes much easier to relate design to economic theories. For example, the holistic nature of Friedrich List’s (1841-4/1966) concepts of the role of state policy in promoting productive powers specifically acknowledges “the art of design” as one of the factors capable of profound influence in improving the manufacturing industry. The evolution of this idea has informed German industry and has been an integral element in its remarkably resilient performance despite political traumas and devastating military defeats.

The continuity of List’s ideas was apparent in the early years of the twentieth century in the work of a liberal politician, Friedrich Naumann, who frequently wrote about the need to harness the potential of mechanization and to create new forms expressing the spirit of the time. In a book, Neudeutsche Wirtschaftspolitik, (New German Economic Policy) published in 1907, Naumann elaborated these ideas. In reviewing the book, Anton Jaumann (1907) observed that Germany’s competitive position was characterized by possession of few natural resources and dependence on imports of raw materials that had to be paid for by manufactured exports. How could it then survive the intense levels of international competition?

We must bring goods to the market that only we can manufacture. We cannot in the long run compete in cheap mass-production. Only quality is our deliverance. If we are able to deliver such excellent goods that can be imitated by no other people in the world and if these goods are so excellent that everyone wishes to buy them, then we have a winning hand. (Jaumann, 1907, p. 338)

Nothing, concluded Jaumann, injured the commercial reputation of a nation as much as the label, “cheap and nasty.” Many countries have faced this problem, the latest being China, which is looking to generate an image of their products based on design and innovation.

The example of Germany also played a very important part in the modernization of Japan, where individualism has similarly played a less prominent role in the country’s economic progress. There too, the role of state policy in initially establishing design competences and encouraging their application in Japanese industry and commerce has been a remarkable example of how, indeed, a government can encourage the development of productive powers. In the mid-1950s, there existed virtually no formally trained professional designers in Japan. As the result of policies introduced by the Ministry of International Trade and Industry (MITI), it was estimated that the country had 21,000 industrial designers alone by 1992. Their development has been an integral part of the success of Japanese products in international markets in the intervening period. Policies based on the Japanese model were also introduced in Korea and Taiwan and similarly have played an important role in their economic growth.

If List’s (1841-4/1966) ideas have been important on a macro-economic level, other schools of theory also have implications for design in micro-economic terms. In this respect, the dynamic view of entrepreneurialism and change advocated by adherents of the Austrian school is particularly valuable. As Lachman (1976) points out, “All economic action is of course concerned with the future, the more or less distant future. But the future is to all of us unknowable, though not unimaginable” (p. 55). Designers also constantly face risk in the challenge of imagining what is as yet unknowable. Although generally silent about design in specific terms, the ideas of the Austrian school reverberate with implications that potentially open up a broader understanding of what the economic role of design can be.

Institutional theory also provides a contextual richness that similarly offers opportunities for a reconsideration of design’s functions, raising important questions on the role of design in society, as generator of the specific forms of a culture, and the institutions that frame its practice. More specifically, theories such as Coase’s (1998) on transaction costs offer enormous possibilities for discussion of how in such fields as information and communications, the role of design can powerfully enhance competitiveness.

New Growth Theory’s inclusion of knowledge, both coded and tacit, as a factor in understanding how business can function also has intriguing possibilities. Of especial value is the argument that technological knowledge has built-in value based on its capacity to derive innovative ideas from practice. A question now raised is whether, or to what degree, design can be incorporated into this concept of knowledge. To some degree knowledge of technological options can open the door to designs contributing to the process of generating innovative ideas. Innovative ideas, of course, are by no means the sole perquisite of designers, but whatever the source, all will need translating into tangible form or definable process in terms acceptable to users, which is the particular skill and contribution of design—its role can be summarized as humanizing technology. There is no significant consideration of these factors in New Growth Theory which, for all its insights, remains embedded in the context of production.

In that context of production, three clear areas of concern for designers can be stipulated:

- Their work must be capable through innovation on multiple levels of contributing to creating new economic value for a firm;

- Given the crucial role assigned to technology in New Growth Theory, an ability to understand technological opportunity and act upon it is required, otherwise designers remain visualisers of other’s ideas or incremental improvers of existing products;

- They must function within institutional structures of various kinds that enable and constrain their endeavours. In other words, they are not independent spirits, but dependent on the view of design held by management or the cultural imperatives of an organization.

Nathan Rosenberg (1982), in examining the problems of technological innovation, points to “a frequent preoccupation with what is technologically spectacular rather than economically significant...” (p. 62) A parallel observation is possible about some problems of design innovation; in this case the preoccupation being with what is visually spectacular rather than economically significant.

The third strand of economic theory, institutional structures, impinges upon design in innumerable ways, even when design is not specifically considered as an element in their workings. For example, laws, such as those in the U.S. on product liability, or those in Germany on recycling packaging materials, or European legislation on recycling electrical and electronic products, profoundly affect design practice. Other factors, including the general cultural climate of a society, the way design is manifested in public and private institutions, whether and how design is taught at all levels of the educational system, and the immediate context of the firms in which or for which designers work, are just a few of the institutional influences that merit close consideration.

Specific attempts to explain design in an economic context have generally sought to justify it in terms of the numerical, quantitative values that dominate business processes. Since the main arena of activity for designers is the firm, however, a major emphasis in discussing the role of design needs to be at the microeconomic level and encompass a greater degree of qualitative factors. A consideration of the functions and processes at the level of the firm could reveal substantial contributions of design to innovation not generally considered in any economic theory.

A further level at which design research could be capable of articulating a role for design not currently articulated in any depth in economic theory is the context of use, of the role played by products, communications, environments, services and systems in the lives of people beyond the point at which most economic theory halts: the point-of-sale. It is in understanding this arena and its human problems, potential and challenges that design is of crucial significance in introducing change that is both meaningful in people’s lives and simultaneously capable of creating sources of competitiveness for firms.

In other words, the next stage of work needs to elaborate concepts of economics through the prism of design theory and practice.

References

- Anonymous (1996, September 28). Making waves: Is information technology different from earlier innovations? The Economist, 340 (7985), S7-S9.

- Arthur, W. B. (1996, July-August). Increasing returns and the new world of business. Harvard Business Review, 74(4), 100-109.

- Chernow, R. (2004). Alexander Hamilton. New York: The Penguin Press.

- CIO Insight (2003, Febuary). Expert voice: Paul Romer on the new economy. CIO Insight, 1(23), 28.

- Coase, R. (1998). The new institutional economics. The American Economic Review, 88(2), 72-74.

- David, P. A. (1993). Knowledge, Property and the System Dynamics of Technological Change. In L. Summers & S. Shah (Eds.), Proceedings of the World Bank Annual Conference on Development Economics 1992 (pp. 215-248). Washington, DC: International Bank for Reconstruction and Development.

- Demsetz, H. (1977). The firm in economic theory: A quiet revolution. The American Economic Review, 87(2), 426-429.

- Demsetz, H. (1997). The primacy of economics: An explanation of the comparative success of economics in the social sciences. Economic Inquiry, 35(1), 1-12.

- Drucker, P. F. (1986). Innovation and entrepreneurship: Practice and principles. New York: Harper Row.

- Friedman, M. (1962). Capitalism and freedom. Chicago: The University of Chicago Press.

- Hayek, F. A. (1948). Individualism and economic order. Chicago: The University of Chicago Press.

- IPod. (n.d.). Retrieved July 12, 2008, from http://en.wikipedia.org/wiki/IPod

- Jaumann, A. (1907). Die Wirtschaftliche Bedeutung der Angewandte Kunst [The economic significance of German applied art]. Innen-Dekoration, 18, 338.

- Klein, P., & Miller, E. (1996). Concepts of value, efficiency, and democracy in institutional economics. Journal of Economic Issues, 30(1), 267-277.

- Lachmann, L. M. (1976). From Mises to Shackle: An essay on Austrian economics and the Kaleidic society. Journal of Economic Literature, 14(1), 54-62.

- List, F. (1966). The national system of political economy. New York: Augustus M. Kelley.

- List, F., Ingersoll, C. J., Liebig, M., & Larouche, L. H. (1996). Outlines of American political economy in twelve letters to Charles J. Ingersoll. Wiesbaden: Bottiger.

- McCormick, K. (1997). An essay on the origin of the rational utility maximization hypothesis and a suggested modification. Eastern Economic Journal, 23(1), 17-30.

- Menger, C. (1976). Principles of economics. (J. Dingwall & B. E. Hoselitz, Trans.). New York: New York University Press. (Original work published 1871)

- Micheline, M. (2008, December 6). At G.M., innovation sacrificed to profits. New York Times. p. B1.

- Mises, L. von. (1949). Human action: A treatise on economics. San Francisco: Fox & Wilkes.

- Nelson, R. H. (2001). Economics as religion: From Samuelson to Chicago and beyond. University Park, PA: The Pennsylvania University Press.

- North, D. C. (1990). Institutions, institutional change and economic performance. Cambridge, MA: Cambridge University Press.

- Polanyi, M. (1983). The tacit dimension. Gloucester, MA: Peter Smith.

- Robinson, P. (1995, June). Paul Romer. Forbes, 15, 66-71.

- Romer, P. M. (1992). Two strategies for economic development: Using ideas and producing ideas. In L. H. Summers (Ed.), Proceedings of the World Bank Annual Conference on Development Economics (pp. 63-92). Washington, DC: International Bank for Reconstruction and Development

- Rosenberg, N. (1982). Inside the black box: Technology and economics. New York: Cambridge University Press.

- Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York: Harper.

- Smith, A. (1937). The wealth of nations. New York: The Modern Library.

- Simon, H. A. (1981). The sciences of the artificial (2nd ed.). Cambridge, MA: The MIT Press.

- Veblen, T. (1990). The instinct of workmanship and the state of the industrial arts. New Brunswick, NJ: Transaction Publishers. (Original work published 1918)

- Veblen, T. (1994). The theory of the leisure class. London: Penguin. (Original work published 1899)

- Wieser, F. von. (1891). The Austrian school and the theory of value. Economic Journal, 1, 108-121.